In the realm of online shopping, Flipkart Pay Later option has become a go-to choice for frequent buyers seeking the convenience of monthly payments. However, circumstances may arise, prompting the need to close your Flipkart Pay Later account. Whether it’s concerns about your CIBIL score, a shift to an alternate payment method, or simply a desire to curb excessive spending, the process to deactivate your account is not always straightforward. In this comprehensive guide, we delineate the exact steps to permanently close your Flipkart Pay Later account, ensuring a smooth transition and addressing potential hurdles along the way.

Access Your Flipkart Account

The initial step involves logging into your Flipkart account using the credentials you used during its creation – your email/phone number and password combination.

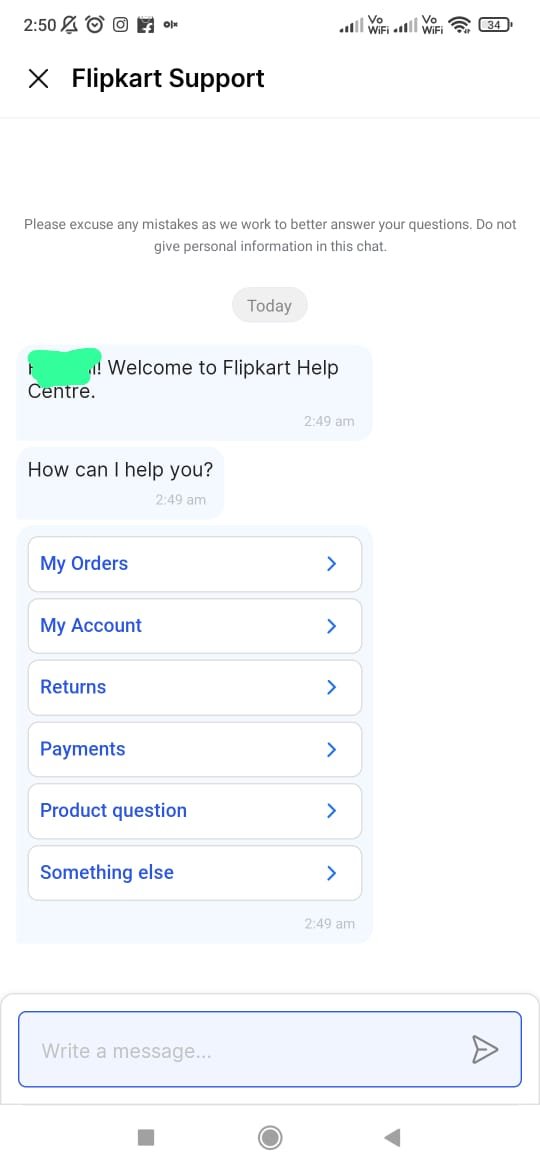

Navigate to the Flipkart Help Center

Once logged in, direct your attention to the upper right corner, where a personalized icon usually resides. This leads you to the Flipkart Help Center, a crucial resource for resolving various issues.

Find the ‘Chat’ or ‘Callback’ Option

Within the Help Center, seek out the “I want help with other issues” option. Subsequently, navigate to “others” at the bottom of the list and tap on it. Look for the callback option within the “others” drop-down menu.

Request a Call Back

Initiate a call back request, and expect a prompt response from a Flipkart customer representative within 5 to 10 minutes. During the conversation, politely articulate your request to disable your Flipkart Pay Later IDFC bank account, emphasizing the need for a permanent closure rather than a temporary deactivation.

Account Closure and Timeline

Post the conversation, your Flipkart Pay Later account will commence the closure process, typically concluding within the next month. Exercise patience, as the closure will be reflected on your CIBIL report as “closed” within 2-3 months.

Send Email for Closure Request

Alternatively, if the aforementioned steps prove challenging, compose an email to “Cs@flipkart.com” from your registered email address, explicitly stating your closure request in the subject line (e.g., “Flipkart Pay Later Closure Request”). While sending an email serves as an alternative, it doesn’t guarantee an immediate response or account closure.

Doxper: A Smart Solution for Digitizing Healthcare Records in India

Contact RBI Ombudsman

If issues persist, approach the Reserve Bank of India’s Ombudsman, presenting your case along with the steps you’ve undertaken. Be thorough in gathering pertinent information before submitting your grievance.

Things to Remember Before Closing

- Clear all outstanding dues before initiating the closure process for a seamless experience.

- Expect to receive a No Objection Certificate (NOC) from your Flipkart Pay Later lending provider (IDFC First Bank) within 2-3 weeks. In case of non-receipt, promptly inquire through the Flipkart Help Center.

- Understand that closing your Flipkart Pay Later account is irreversible, and reapplication is not an option once closed.

Closing your Flipkart Pay Later account is a consequential decision. This guide aims to empower you with precise steps, ensuring a successful account closure. We trust that these instructions on “how to close Flipkart Pay Later” will prove instrumental in your journey.

+ There are no comments

Add yours